This article is for paid members only

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In

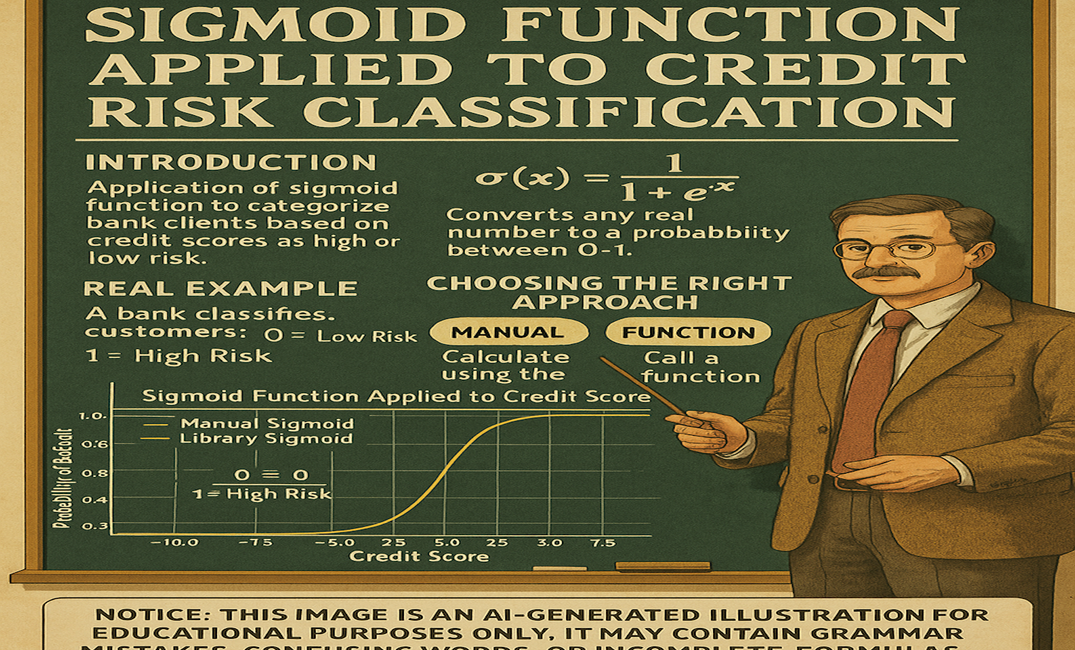

MACHINE LEARNING – Sigmoid Function Applied to Credit-Risk Classification

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In