This article is for paid members only

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In

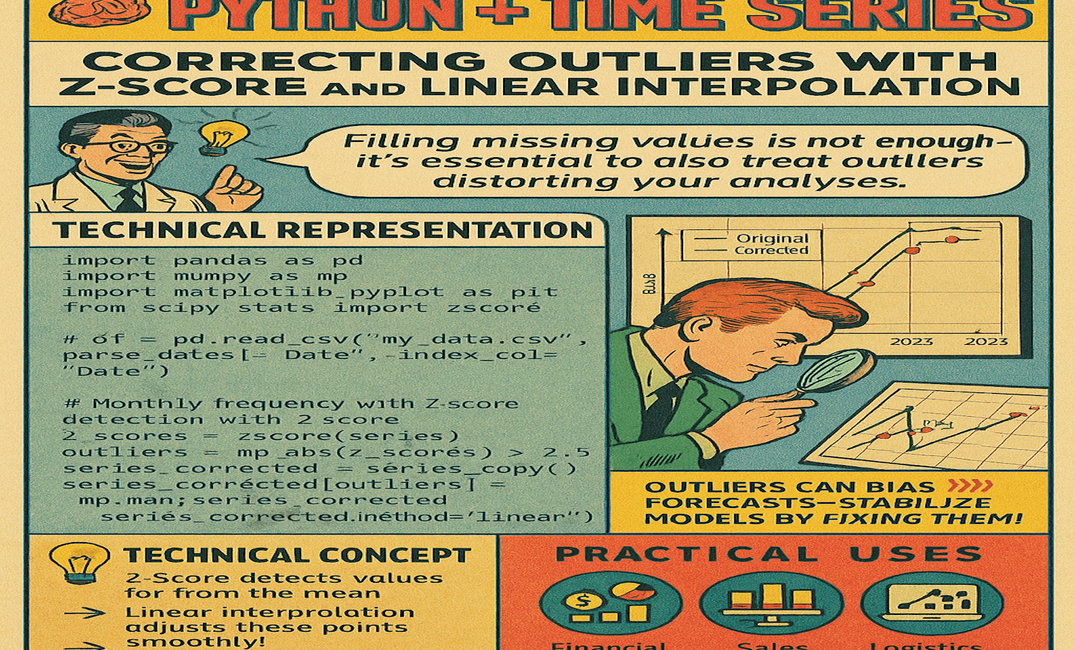

PYTHON + TIME SERIES – Correcting Outliers with Z-Score and Linear Interpolation

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In